When carbon emission rights are valued and become corporate assets

19/12/2023

From the national greenhouse gas emission reduction target, allocated allowances have become valuable assets for businesses. To enhance their competitive position, businesses need to proactively exploit new opportunities from carbon pricing as soon as this market begins to operate in Vietnam.

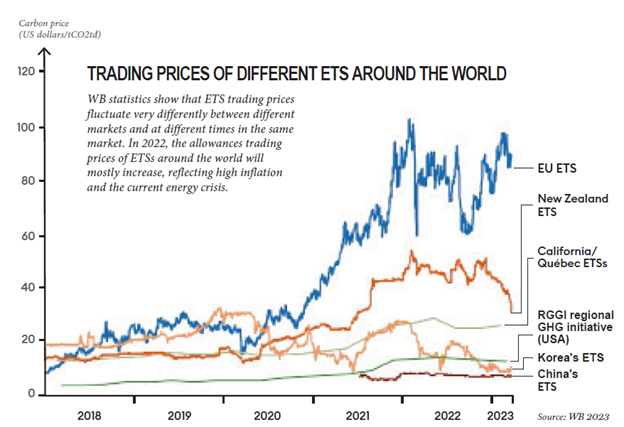

Despite the challenging backdrop for governments grappling with high inflation, financial pressures, and energy crises, revenue from carbon taxes and the Emissions Trading System (ETS) has reached a record high of around 95 billion USD – according to the World Bank (WB)’s annual report on “Carbon pricing status and trends” released in May 2023.

Human activities are estimated to have warmed the Earth by about 1°C compared to pre-industrial temperatures. Global warming caused by cumulative anthropogenic greenhouse gas (GHG) emissions since the pre-industrial era will last for centuries to millennia, continuing to induce long-term changes in the climate system, such as rising sea levels and other adverse impacts. If GHG emissions are not significantly and immediately reduced across all sectors to limit global warming to 1.5°C, the adverse effects on climate and life on Earth will be irreversible. To date, 196 countries have collectively joined the Paris Agreement on climate change, committing to reduce GHG emissions and collaborate to achieve the 1.5°C target. To achieve this goal, global GHG emissions need to be reduced by approximately 45% of 2010 levels by 2030, with net-zero emissions achieved by 2050, according to forecasting models.

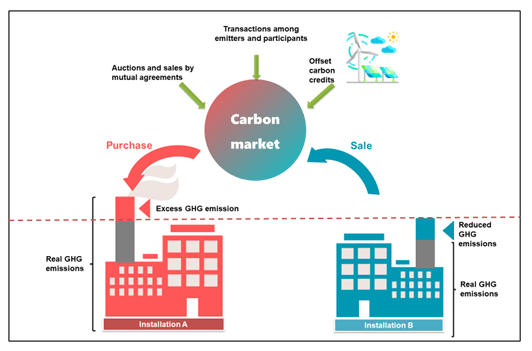

When emitted into the atmosphere, GHG is not “local” – emissions from any location or source, when converted to the common unit of tons of CO2 equivalent (CO2eq), contribute equally to global warming. However, the cost of reducing emissions varies significantly among different sources, depending on the level of technology as well as economic and societal characteristics… Based on this characteristic, the global community has established mechanisms to facilitate transactions for priced GHG emissions (known as carbon pricing) to achieve cost-effective global GHG reduction. This forms the basis of the current carbon market at all different scales (international, national, regional, and sectoral…). GHG pricing (usually expressed per ton of CO2eq, so it is referred to as carbon pricing) is an approach to reduce GHG emissions by utilizing market mechanisms, where entities responsible for GHG emissions incur costs for releasing emissions into the atmosphere, according to the “polluter pays” principle.

The carbon market plays a crucial role in achieving emission reduction goals at low costs, serving as an effective tool to mobilize private investment and promote innovation in clean technologies.

The carbon market is instrumental in helping countries enhance their emission reduction ambitions, as they can achieve emissions reductions at lower costs. WB’s research shows that global carbon emission reductions could increase by an additional 50% annually with the presence of a carbon market. As of the WB’s May 2023 report, the application of carbon pricing instruments is progressively expanding each year in 73 countries and regions, covering approximately 23% of the total global GHG emissions.

APPLYING CARBON PRICING INSTRUMENTS IN VIETNAM

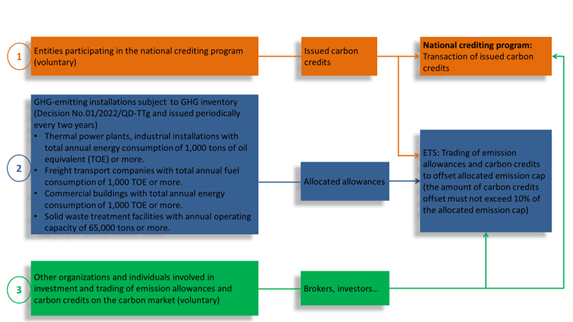

As a participant in the Paris Agreement, Vietnam has committed to an unconditional target of reducing GHG emissions by 15.8% (with domestic resources) and a conditional target of 43% (with international support) by 2030 compared to the business-as-usual scenario. Based on this national target, specific targets and measures for GHG emission reduction have been developed for five key sectors, including energy, transportation, industrial processes, construction, and waste. Correspondingly, large emitters in these sectors are required to conduct GHG inventories and implement measures to reduce GHG emissions. In order to help businesses achieve their GHG emission reduction targets flexibly and at low cost, the government has stipulated the establishment and trading of GHG emission allowances and carbon credits on the carbon credit exchange and domestic carbon market (Decree No. 06/2022/NĐ-CP dated January 7, 2022, on regulations on mitigation of GHG emissions and protection of ozone layer). According to this decree, Vietnam’s carbon market until 2030 includes two carbon pricing instruments:

- Emissions Trading System (ETS)– also known as a cap-and-trade system: The government sets a cap on the total direct GHG emissions for specific emitting entities (referred to as emission caps) and establishes a market for trading emission rights (emission allowances). Each allowance corresponds to 1 ton of CO2eq, and the emission cap represents the total number of allowances allocated to a facility.

- Credit exchange mechanism: Project activities such as clean energy projects, waste treatment, conservation, and afforestation, or carbon storage projects…, carried out by businesses, government, or policies, which result in emissions reductions can be bought or sold. Emission reductions must be verified by an independent third party and must be officially registered to become tradable carbon credits on the carbon market (each credit is equivalent to 1 ton of CO2eq).

Through allocating GHG emission allowances to specific emitting facilities, businesses are obliged to achieve emissions targets within the granted allowances but have the right to trade them on the ETS. Additionally, carbon credits can be offset against the allocated emission cap (but not exceeding 10% of that cap). Thus, from the national GHG reduction target, the allocated allowances have become valuable assets for businesses and are valued on ETS, credits generated from renewable energy projects, and low-carbon emissions… are traded for mandatory or voluntary emission offsetting and converted into emission rights on the ETS at a limited rate.

To fulfill these emission reduction obligations and engage in ETS trading, businesses first need to inventory their GHG emissions and evaluate the potential of GHG emission reduction measures and their implementation costs compared to their industry or sub-industry benchmark. From there, they can develop the most cost-effective GHG reduction strategy. Businesses may choose to invest in reducing emissions at their facilities if the cost is lower than the allowance and credit prices on the ETS. Alternatively, they may opt to purchase allowances and credits to offset high emissions or even face penalties imposed by the government in the opposite scenario.

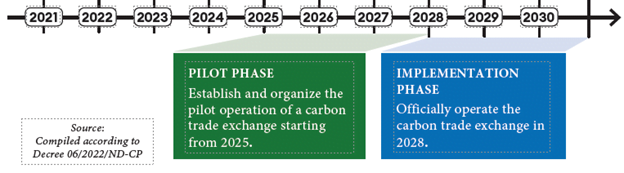

CARBON MARKET DEVELOPMENT ROADMAP IN VIETNAM

The roadmap includes three main phases, with the preparation phase lasting until 2025. Experience from developing and operating the ETS of other countries shows that in the first phase, there is only a limited number of businesses participating in the ETS due to the need to refine policy mechanisms to manage and operate ETS, allowing stakeholders to become familiar with and adapt to ETS. For Vietnam, it is expected that in the pilot phase (2025 – 2027), only businesses in the cement, steel, and thermal power sectors will be subjected to emission caps and allowed to trade on the ETS. After the market develops and officially operates from 2028 onwards, the number of participating businesses and stakeholders will be expanded. The Ministry of Natural Resources and Environment, in coordination with relevant ministries, will oversee the pilot and official operation of the carbon credit trading platform to manage and monitor the carbon market; the Ministry of Finance will preside over the development and establishment of a carbon credit trading platform and promulgate a financial management mechanism for carbon market activities.

Preparation phase

- Develop regulations for carbon credit management, and activities related to the exchange of GHG emission allowances, and develop regulations for operating the carbon credit trading platform.

- Guide MRV monitoring.

- Establish the carbon credit trading platform.

- Develop a national GHG inventory system.

- Implement a pilot program for carbon credit exchange and offset mechanisms in potential sectors and provide guidance on implementing domestic and international carbon credit exchange and offset mechanisms.

- Develop propaganda materials and conduct capacity-building activities for participants in the carbon market.

PARTICIPANTS IN THE CARBON MARKET IN VIETNAM

Decree No. 06/2022/NĐ-CP stipulates three groups of participants in the domestic carbon market.

IMPACT OF DOMESTIC AND FOREIGN GHG EMISSION REDUCTION POLICIES ON VIETNAMESE BUSINESSES

Together with the international community, the Vietnamese Government has committed to achieving a net-zero carbon emissions target by 2050. Controlling and reducing GHG emissions at businesses will directly contribute to realizing this commitment. Initially, large enterprises and establishments will be mandated to report and disclose information and plans to reduce GHG emissions. Subsequently, these businesses will be subject to emission caps starting from 2028 (some businesses within the pilot scope will be applied from 2025).

Following global trends, disclosing information on GHG emissions is both mandatory according to national regulations and a requirement of trading partners and consumers. The number of companies disclosing information on GHG emissions has been steadily increasing each year, albeit slowly (from 15% in 2019 to 16.2% in 2021). However, the practice of disclosing GHG inventory results (calculating carbon footprints) and reducing GHG emissions is relatively new for most domestic businesses. If the current trend continues, Vietnam may lag behind neighboring countries in exporting goods, potentially losing ground even in the domestic market as consumer awareness of climate change increases.

Vietnam’s textile and garment industry has lost many orders to businesses in Bangladesh, a country that rose to the world’s second position in 2022 and maintained this position in 2023. Statistics indicate that in the first two months of 2023, Vietnam’s export turnover to the United States decreased by 15%, while Bangladesh’s only decreased by 2%. One of the main reasons is that Vietnam has lagged behind Bangladesh in green transformation within the industry. In Bangladesh, the government has implemented policies to reduce GHG emissions and enhance the use of renewable energy, along with providing necessary financial support to the textile and garment industry for greening the supply chain over the past several years.

On December 13, 2022, the European Union (EU) announced the implementation of the Carbon Border Adjustment Mechanism (CBAM). Accordingly, certain goods exported to the EU market will be subject to carbon taxes based on the intensity of GHG emissions in the production process in the host country. Estimates suggest that CBAM could constitute up to 20% of the cost of steel products exported to the EU when fully effective. According to a 2023 survey conducted by the CBAM Impact Assessment project under the Ministry of Natural Resources and Environment, over 60% of surveyed businesses have heard about CBAM, but most have limited understanding or only grasp basic information. Businesses with low awareness may struggle to comprehend and prepare for CBAM reporting requirements. With high emission reduction costs, Vietnamese businesses may face difficulties in improving and transitioning to clean energy and clean technologies with low carbon intensity. Consequently, they may incur higher CBAM taxes, reducing their competitive advantage significantly.

During the 2023–2024 period, several sponsors will support the Ministry of Natural Resources and Environment in conducting training sessions and simulations of ETS to equip stakeholders with essential knowledge for participating in ETS in Vietnam. There is not much time left for businesses to prepare the technical capacity to comply with new emission reduction obligations and seize opportunities from the domestic carbon market.

Along with participating in training programs and building sufficient capacity, businesses need to assess the impact of policies related to GHG emissions reduction on their development goals. However, before that, it is necessary to have information on current emission levels through the GHG emission inventory. From there, businesses can proactively come up with decarbonization strategies to gain a competitive edge in both domestic production and export activities. At the same time, businesses should also actively explore new opportunities arising from carbon pricing as soon as this market begins to operate in Vietnam.

Source: Forbes Viet Nam

Printed version according to Forbes Vietnam magazine No. 119, July 2023.

Author: Dang Hong Hanh, Co-founder, and CEO of VNEEC.